CVP analysis 知识点总结+真题讲解(下) | ACCA Cloud

- 2020年12月31日

- 15:00

- 来源:高顿ACCA

- 阅读:(137)

2024ACCA备考资料

- 财务英语入门

- 历年考题答案

- 2024考纲白皮书

- 2024考前冲刺资料

- 高顿内部名师讲义

- 高顿内部在线题库

摘要:同学们大家好,今天老师带大家一起来看看CVP analysis这个部分的真题应该怎么做~ 再送大家一个2021ACCA资料包,可以分享给小伙伴,自提,戳: ACCA资料【新...

同学们大家好,今天老师带大家一起来看看CVP analysis这个部分的真题应该怎么做~ 再送大家一个今年新版的ACCA资料包,可以分享给小伙伴,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

01 2018.3&6

The Alka Hotel is situated in a major city close to many theatres and restaurants.

The Alka Hotel has 25 double bedrooms and it charges guests$180 per room per night,regardless of single or double occupancy.The hotel’s variable cost is$60 per occupied room per night.

The Alka Hotel is open for 365 days a year and has a 70%budgeted occupancy rate.Fixed costs are budgeted at$600,000 a year and accrue evenly throughout the year.

During the first quarter(Q1)of the year the room occupancy rates are significantly below the levels expected at other times of the year with the Alka Hotel expecting to sell 900 occupied room nights during Q1.Options to improve profitability are being considered,including closing the hotel for the duration of Q1 or adopting one of two possible projects as follows:

Project 1-Theatre package

For Q1 only the Alka Hotel management would offer guests a‘theatre package’.Couples who pay for two consecutive nights at a special rate of$67·50 per room night will also receive a pair of theatre tickets for a payment of$100.The theatre tickets are very good value and are the result of long negotiation between the Alka Hotel management and the local theatre.The theatre tickets cost the Alka Hotel$95 a pair.The Alka Hotel’s fixed costs specific to this project(marketing and administration)are budgeted at$20,000.

The hotel’s management believes that the‘theatre package’will have no effect on their usual Q1 customers,who are all business travellers and who have no interest in theatre tickets,but will still require their usual rooms.

Project 2-Restaurant

There is scope to extend the Alka Hotel and create enough space to operate a restaurant for the benefit of its guests.

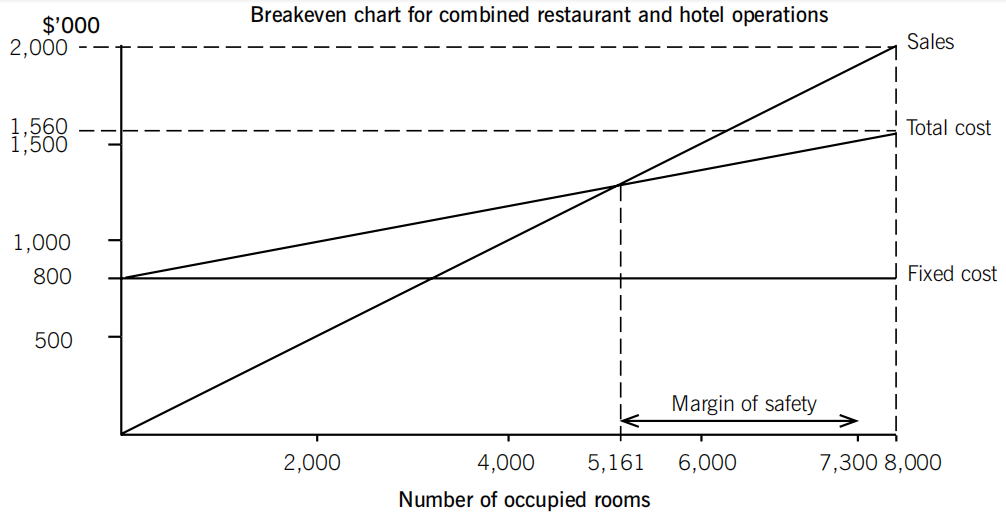

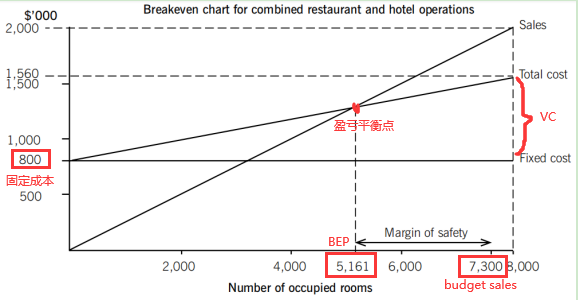

The annual costs,revenues and volumes for the combined restaurant and hotel are illustrated in the following graph:

Note:The graph does not include the effect of the‘theatre package’offer.

Required:

(a)Using the current annual budgeted figures,and ignoring the two proposed projects,calculate the breakeven number of occupied room nights and the margin of safety as a percentage.(4 marks)

(b)Ignoring the two proposed projects,calculate the budgeted profit or loss for Q1 and explain whether the hotel should close for the duration of Q1.(4 marks)

(c)Calculate the breakeven point in sales value of Project 1 and explain whether the hotel should adopt the project.(4 marks)

(d)Using the graph,quantify and comment upon the financial effect of Project 2 on the Alka Hotel.

Note:There are up to four marks available for calculations.(8 marks)

02 分析过程

第一步:首先看分数,按分估小点,宜多不宜减;

4分的题目通常就需要回答到两个点,如果题中考的是简单定义的默写有可能会一分一个点;

8分的题目通常是4个点每个点2分。

第二步:问题要先读,圈出关键词,分析知识点;

(a)计算BEP和margin of safety as a percentage,结合上一步的分析,确定按照一个计算两分写;(需要注意的是,考生做题的时候过程尽量写详细,结果算错了但是过程正确是有分的)

(b)忽略这两个项目,计算第一季度的预算利润或亏损,并解释酒店是否应该在第一季度关闭。基本可以看出是calculate和explain一个两分。

(c)计算项目1的BER,说明酒店是否应该采用该项目。基本可以看出是calculate和explain一个两分。

(d)利用图表,量化并评论项目2对Alka酒店的财务影响。下面批注了计算可以占4分,剩下四分是文字。

以上是对问题的分析,可以看出前面两个问题都是和project 1&2没有关系的,所以先带着前两个问题看Project 1-Theatre package之前的背景。然后再分别看第三个和第四个问题。

第三步:开始读题目,带着问题读,高亮标题干;

(a)(b)问先读Project 1-Theatre package之前:

•25 double bedrooms,$180 per room per night:25间双人房,无论是单人房还是双人房,每个房间每晚收费180美元

•variable cost is$60 per occupied room per night:每间客房每晚60美元

•365 days a year,70%budgeted occupancy rate

•Fixed costs$600,000 a year

•First quarter(Q1)sell 900 occupied room nights

(a)问的是计算,先把公式写上,然后带入数据。带数据过程中发现由某一个数据是题中没有告诉的,建议写Working,因为机考时EXCEL表格不能插入行。

BEP=Fixed cost/contribution per room per night=$600,000/$120(W1)=5000 occupied room nights

Margin of safety as a percentage=(Budgeted room occupancy–breakeven room occupancy)/budgeted room occupancy=(6387.5(w2)-5000)/6387.5(w2)=21.72%

Working 1:

Contribution per room=sales price per room per night-variable cost=$180-$60=$120 per room per night

Working 2:

Budgeted room occupancy=25 double bedrooms*365 days a year*70%budgeted occupancy rate=6387.5 occupied room nights

(b)问的是计算结合文字,习惯写法是先把计算写出来,然后再分析。

Profit or loss for Q1:

Total Contribution=Contribution per room*occupied room nights=$120*900=$108000

Profit/loss=total contribution-FC=$108000-$600,000*(3/12)=$-42000

(一定要注意这里的FC只算一个季度的,也就是3个月)

Explain whether the hotel should close for the duration of Q1:

如果关闭,损失销售收入节约变动成本,也就是损失contribution:108000

但是固定成本$600,000*(3/12)=150000不会被节约,普通的固定成本只有关闭企业完全不生产之后才可以被节约。

所以最后观点是should not close,书写过程为:

The Alka Hotel should not close in Q1.(先把观点摆出来)

The fixed costs will still be incurred and closure would result in lost contribution of$108,000.This in turn would result in a decrease in annual profits of$108,000.(根据背景解释原因)

In addition,the hotel could lose customers at other times of the year,particularly their regular business customers,who may perceive the hotel as being unreliable.(开脑洞,根据实际情况去分析有可能出现的情况,这一点不一定和答案相同,言之有理即可)

第三步:开始读题目,带着问题读,高亮标题干;

•two consecutive nights at a special rate of$67.50 per room night will also receive a pair of theatre tickets for a payment of$100.:连续两晚以67.50美元/间的特殊价格入住的夫妇还将获得两张剧院门票。也就是sales price=$67.50*2+$100=$235.

•theatre tickets cost$95 a pair

•fixed costs specific to this project$20,000.

(c)问的是计算结合文字,习惯写法是先把计算写出来,然后再分析。需要注意的是本小问的项目是一个单独的项目,对原来的客户没有影响(have no effect on their usual Q1 customers),所以评估的时候也是单独评估。

BER of project 1=Fixed cost/C/S ratio=$20,000/8.51%(w3)=$235017.63

Working 3:注意收入和变动成本都是由两个部分组成。

Sales price=$67.50*2+$100=$235

VC=$60*2+$95=$215

Contribution=$235-$215=$20

C/S ratio=$40/$235.=8.51%

Explain whether the hotel should adopt the project:

从上面的计算可以看出,单位贡献是$20比较低,如果要让contribution覆盖掉固定成本$20,000,需要1000个两晚+影院票卖出去,也就是2000 occupied room nights。Q1可获得的房间数是25*365*(3/12)=2281.25 room nights,其中正常的客户需要900晚,所以是不够的,should not adopt project 1.

Project 1 is not viable at the quoted prices.(通常习惯把结论放前面,让考官明确你的观点)

The unit contribution per theatre package is low and it requires a large number of sales to break even.Each theatre package would require two room nights to be sold which would mean 2,000 room nights needed in Q1 to break even.(需要的)

The available rooms for Q1 are only 2,281·25(9,125/4)and the Alka Hotel has already sold 900 rooms,so there is insufficient capacity.(可获得的)

第三步:开始读题目,带着问题读,高亮标题干;

(这个题的题干很少,主要是图像,所以先在草稿纸上分析图像)

(d)问是文字+计算,但是不按照先写计算再写文字,因为计算一开始没办法明确算的是什么,最好是根据文字的逻辑去计算。

•销售收入:找到sales直线上唯一一个标了横纵坐标的点(8000,2000000),所以sales price=2000000/80000=$250,以前是$180 per room per night,可以看出餐厅业务平均每间房每晚增加了70的收入。

•变动成本:total cost和fixed cost之间的差异就是VC,所以8000 rooms对应的VC是1560000-800000=760000,VC per room=760000/8000=$95 per room。相比于以前的$60 per room增加了$35 per room,这反映了餐厅业务的可变成本。

•固定成本:从600000变到了800000,因为餐厅业务增加了200000的成本;

•由于这些变化,收支平衡点从5000间客房增加到5161间客房(图中直接看出),因此酒店需要销售更多的客房夜来弥补成本。

•当前的预计销售房间数是7300(图像中),占总数的80%(7300/9125),安全边际是(7300-5161)/7300=29.30%,这是大于当前的安全边际的(29.30%>21.72%),风险更小了。

•利润:sales-total cost=7300*$250-7300*$95 per room-800000=$331,500

再送大家一个今年新版的ACCA资料包,可以分享给小伙伴,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

推荐:考生都在用的ACCA资料>>【领取2023ACCA完整资料】 (资料包含ACCA必考点总结,提升备考效率,加分必备)

版权声明:

1、凡本网站注明“来源高顿ACCA”或“来源高顿、ACCA学习帮”,的所有作品,均为本网站合法拥有版权的作品,未经本网站授权,任何媒体、网站、个人不得转载、链接、转帖或以其他方式使用。

2、经本网站合法授权的,应在授权范围内使用,且使用时必须注明“来源高顿ACCA”或“来源高顿、ACCA学习帮”,并不得对作品中出现的“高顿”字样进行删减、替换等。违反上述声明者,本网站将依法追究其法律责任。

3、本网站的部分资料转载自互联网,均尽力标明作者和出处。本网站转载的目的在于传递更多信息,并不意味着赞同其观点或证实其描述,本网站不对其真实性负责。

4、如您认为本网站刊载作品涉及版权等问题,请与本网站联系(邮箱fawu@gaodun.com,电话:021-31587497),本网站核实确认后会尽快予以处理。

分享到:

急速通关计划

ACCA全球私播课

周末面授班

其他课程

报考指南

最新ACCA备考机经

价值1288元 考试必备资料 免费领取 高顿ACCA研究院独家出品

价值1288元 考试必备资料 免费领取 高顿ACCA研究院独家出品

领取ACCA资料包

大家都在看

-

阅读(9579)

-

阅读(9083)

-

阅读(9068)

-

阅读(8764)

-

阅读(8739)

日排行 • 周排行

- 1 acca课程体系?acca考试具体内容有哪些?

- 2 ACCA FM | NPV和IRR两大评估方式+对比

- 3 acca考试具体内容有哪些?

- 4 acca考出来对进四大有帮助吗?

- 5 ACCA让我不再迷茫,打开全新视野!

- 6 超详细ACCA报考流程

- 7 ACCA F2重要考点解析

- 8 FA之Provision如何拿满分丨ACCA Cloud

- 9 ACCA知识点:增值激励计划

- 10 ACCA考试科目这盘“大餐“怎么搭配最“营养”

- 1 2023年ACCA考试科目通过率排名:哪些科目最容易通过?

- 2 2024年参加12月acca考试带什么?准考证可以打印了吗?

- 3 2024年accaf1裸考能过吗?历年通过率多少?

- 4 定了!2023年acca要考几年能考下来?要考几科才可以拿出去面试?

- 5 2024年acca要考几门?按什么顺序考?

- 6 2023年申请acca免考科目的条件?最多可以免考几门科目?

- 7 2023年哪些大学财会专业比较好?没错了,就是这几所!

- 8 acca学姐来解答2023年acca是什么考试?各科目全称是什么?

- 9 速看!2023年会计学acca是什么意思?一文教你看懂!

- 10 定了!2023年acca考位满了还有可能报上吗?

-

ACCA考试热门词

-

ACCA内部备考资料高顿ACCA为您免费提供全新ACCA资料,包括历年考题、考官报考、考官文章、考纲解析、学霸笔记、内部讲义等,同时还助您了解新学员报名注册指南、机考报考考试引导、OBU&UOL申请攻略等,点击免费获取。

-

- ACCA常见问题

- ACCA推荐阅读

- ACCA考试资讯

- ACCA原创文章

- ACCA学霸分享

- ACCA常见问答