ad debt & Doubtful debt的会计处理和计算 | ACCA Cloud

- 2020年09月11日

- 10:32

- 来源:高顿ACCA

- 阅读:(99)

2024ACCA备考资料

- 财务英语入门

- 历年考题答案

- 2024考纲白皮书

- 2024考前冲刺资料

- 高顿内部名师讲义

- 高顿内部在线题库

摘要:今天帮主邀请July老师,为大家讲解坏账和坏账准备相关知识点,大家记好笔记。 文丨July 大家好,Bad debtDoubtful debt是大家经常会有问题的一个知识点,今天...

今天帮主邀请July老师,为大家讲解坏账和坏账准备相关知识点,大家记好笔记。

文丨July

大家好,Bad debt&Doubtful debt是大家经常会有问题的一个知识点,今天呢就给大家系统的梳理一下坏账和坏账准备,并以一道例题为例给大家做一个讲解。

01 What is Bad debt&Doubtful debt

1.Dad debt:

☞If a debt is definitely irrecoverable it should be written off to statement of profit or loss as a bad debt.

☞对应收账款影响:减少Trade receivable balance

2.Doubtful debt:

☞If a debt is possibly irrecoverable an allowance for the potential irrecoverability of that debt should be made.

☞分类:

1)Specific allowance:

针对某个特定客户的坏账准备(Particular/named individual customer)。

2)General allowance=(Trade receivable balance-Bad debt-Specific allowance)*n%

公司跟据以往经验确定一个Trade receivable减去Bad debt和Specific allowance后可能发生坏账的百分比。

对应收账款影响:不减少Trade receivable balance

02 Initial recognition

1.Bad debt:

Dr Receivable expense(SPL)

Cr Trade receivables(SOFP)

2.Specific allowance&General allowance

Dr Receivable expense(SPL)

Cr Allowance for receivables(SOFP)

03 ★★★Subsequent change in bad debt and doubtful debt

1.Initial bad debt->Subsequent recovered(坏账收回)

直接记录收到了现金,抵消过去记录的坏账费用,不影响Trade receivable:

Dr Cash

Cr Receivable expense

2.Initial specific debt->Subsequent recovered(坏账准备收回)

1)第一步:抵消过去记录的坏账准备:

Dr Allowance for receivables

Cr Receivable expense

2)第二步:记录我们收到的现金:

Dr Cash

Cr Trade receivables

3.Initial specific debt->Subsequent go bad(坏账准备变成坏账)

因为坏账准备和坏账都是Receivable expense且坏账准备变成坏账时金额没有发生改变,所以坏账准备变成坏账不影响Receivable expense,也不影响Profit:

Dr Allowance for receivables

Cr Trade receivables

04 Receivable expense的计算

Receivable expense=Bad debt+Movement in allowance

=Bad debt+(Closing allowance-Opening allowance)

05 例题

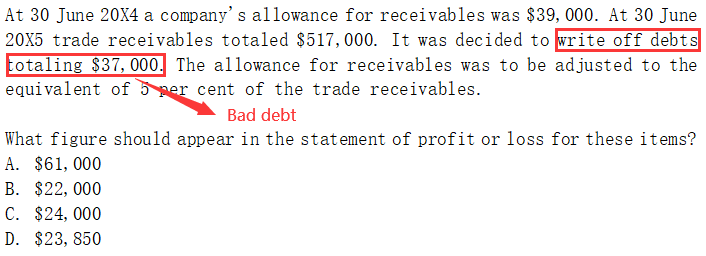

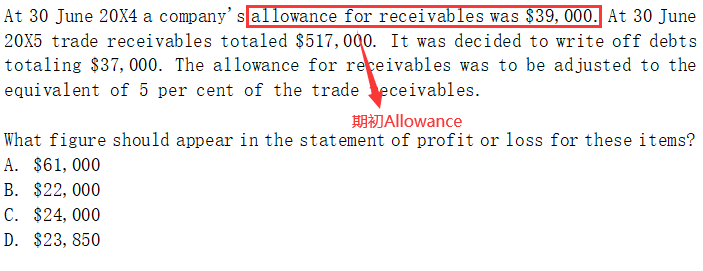

At 30 June 20X4 a company's allowance for receivables was$39,000.At 30 June 20X5 trade receivables totaled$517,000.It was decided to write off debts totaling$37,000.The allowance for receivables was to be adjusted to the equivalent of 5 per cent of the trade receivables.

What figure should appear in the statement of profit or loss for these items?

A.$61,000

B.$22,000

C.$24,000

D.$23,850

分析:题目让求在利润表中记录的坏账和坏账准备的费用的金额,也就是求计入利润表的Receivable expense。

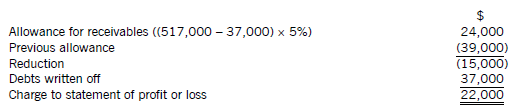

Step1:

Receivable expense=Bad debt+Movement in allowance

=Bad debt+(Closing allowance-Opening allowance)

Step2:

Bad debt题目信息直接给了=37000

Step3:

Movement in allowance=Closing allowance-Opening allowance

=(517000-37000)*5%-39000=-15000

Step4:

Receivable expense=Bad debt+Movement in allowance=37000-15000=22000

所以这道题答案选择B。

以上就是我们坏账和坏账准备的内容,重点需要大家掌握的就是:

✔Allowance的计算

✔Receivable expense的计算

✔坏账收回,坏账准备变坏账,坏账准备收回的会计处理

推荐:考生都在用的ACCA资料>>【领取2023ACCA完整资料】 (资料包含ACCA必考点总结,提升备考效率,加分必备)

版权声明:

1、凡本网站注明“来源高顿ACCA”或“来源高顿、ACCA学习帮”,的所有作品,均为本网站合法拥有版权的作品,未经本网站授权,任何媒体、网站、个人不得转载、链接、转帖或以其他方式使用。

2、经本网站合法授权的,应在授权范围内使用,且使用时必须注明“来源高顿ACCA”或“来源高顿、ACCA学习帮”,并不得对作品中出现的“高顿”字样进行删减、替换等。违反上述声明者,本网站将依法追究其法律责任。

3、本网站的部分资料转载自互联网,均尽力标明作者和出处。本网站转载的目的在于传递更多信息,并不意味着赞同其观点或证实其描述,本网站不对其真实性负责。

4、如您认为本网站刊载作品涉及版权等问题,请与本网站联系(邮箱fawu@gaodun.com,电话:021-31587497),本网站核实确认后会尽快予以处理。

分享到:

急速通关计划

ACCA全球私播课

周末面授班

其他课程

报考指南

最新ACCA备考机经

价值1288元 考试必备资料 免费领取 高顿ACCA研究院独家出品

价值1288元 考试必备资料 免费领取 高顿ACCA研究院独家出品

领取ACCA资料包

大家都在看

-

阅读(9579)

-

阅读(9083)

-

阅读(9068)

-

阅读(8764)

-

阅读(8739)

日排行 • 周排行

- 1 acca课程体系?acca考试具体内容有哪些?

- 2 ACCA FM | NPV和IRR两大评估方式+对比

- 3 acca考试具体内容有哪些?

- 4 acca考出来对进四大有帮助吗?

- 5 ACCA让我不再迷茫,打开全新视野!

- 6 超详细ACCA报考流程

- 7 ACCA F2重要考点解析

- 8 FA之Provision如何拿满分丨ACCA Cloud

- 9 ACCA知识点:增值激励计划

- 10 ACCA考试科目这盘“大餐“怎么搭配最“营养”

- 1 2023年ACCA考试科目通过率排名:哪些科目最容易通过?

- 2 2024年参加12月acca考试带什么?准考证可以打印了吗?

- 3 2024年accaf1裸考能过吗?历年通过率多少?

- 4 定了!2023年acca要考几年能考下来?要考几科才可以拿出去面试?

- 5 2024年acca要考几门?按什么顺序考?

- 6 2023年申请acca免考科目的条件?最多可以免考几门科目?

- 7 2023年哪些大学财会专业比较好?没错了,就是这几所!

- 8 acca学姐来解答2023年acca是什么考试?各科目全称是什么?

- 9 速看!2023年会计学acca是什么意思?一文教你看懂!

- 10 定了!2023年acca考位满了还有可能报上吗?

-

ACCA考试热门词

-

ACCA内部备考资料高顿ACCA为您免费提供全新ACCA资料,包括历年考题、考官报考、考官文章、考纲解析、学霸笔记、内部讲义等,同时还助您了解新学员报名注册指南、机考报考考试引导、OBU&UOL申请攻略等,点击免费获取。

-

- ACCA常见问题

- ACCA推荐阅读

- ACCA考试资讯

- ACCA原创文章

- ACCA学霸分享

- ACCA常见问答