MA(F2)吸收成本法和边际成本法的对比 | ACCA Cloud

- 2020年04月08日

- 14:33

- 来源:ACCA学习帮

- 阅读:(109)

2024ACCA备考资料

- 财务英语入门

- 历年考题答案

- 2024考纲白皮书

- 2024考前冲刺资料

- 高顿内部名师讲义

- 高顿内部在线题库

摘要:今天来总结一下Management Accounting里面的一大重难点,吸收成本法(Absorption costing)和边际成本法(Marginal costing)两者之间的主要区别和联系。 01 利润计算...

今天来总结一下Management Accounting里面的一大重难点,吸收成本法(Absorption costing)和边际成本法(Marginal costing)两者之间的主要区别和联系。

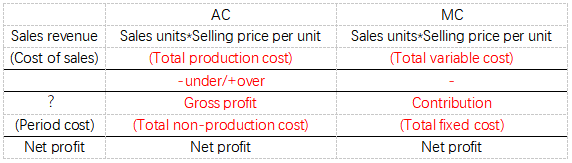

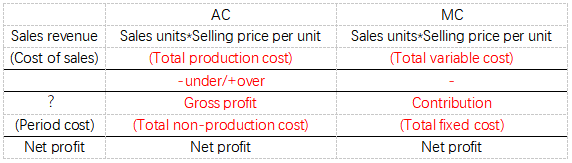

01 利润计算方法

文字解释:

① COS:按销量计算,卖掉多少减多少。

吸收成本法下计入产品成本的只有total production cost(fixed production overhead&variable production overhead),当期销售出去的存货成本结转到利润表,即total production cost of sales;

边际成本法下计入产品成本的只有total variable cost(variable production overhead&variable non-production overhead),当期销售出去的存货成本结转到利润表,即total variable cost of sales。

② Under/over absorption:吸收成本法特有的,边际成本法不存在OAR和Under/over absorption。

涉及的计算公式:

Under/over absorption=Actual overhead-Absorbed overhead

Absorbed overhead=OAR*Actual activity level

OAR=Budget production overhead/Budget activity level

③ Sales-COS:

吸收成本法下的主营业务收入-主营业务成本叫做Gross profit毛利润;

边际成本法下的主营业务收入-主营业务成本叫做Contribution贡献。

④ Period cost:当期发生多少减多少。

吸收成本法下包含total non-production cost;

边际成本法下包含total fixed cost

⑤ Valuation of closing inventory:Absorption costing>Marginal costing。

吸收成本法存货计价:Direct material+Direct labour+Variable production overhead+Fixed production overhead;

边际成本法存货计价:Direct material+Direct labour+Variable production overhead;

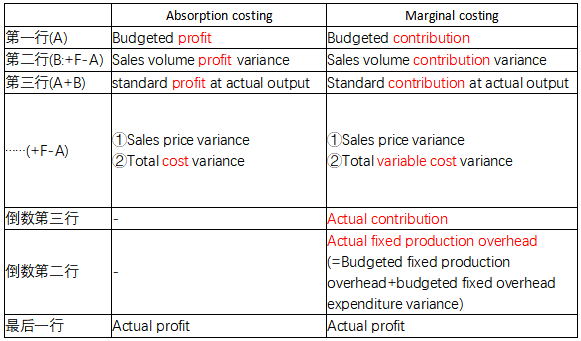

02 标准成本法中的差异

① Cost variance---fixed production overhead variance

Absorption costing:

A.fixed production overhead total variance=under/over absorbed overhead

B.fixed production overhead expenditure variance=budgeted overhead-actual overhead

C.fixed production overhead volume variance=budgeted units*OAR-actual units*OAR

D.fixed production overhead volume efficiency variance=(budgeted hours at actual output-actual hours)*standard production overhead per hour

E.fixed production overhead variance=(budgeted hours-actual hours)*standard production overhead per hour

Marginal costing:(因为MC法下不存在OAR,所以对于fixed production overhead variance只有expenditure variance)

fixed production overhead expenditure variance=budgeted overhead-actual overhead

② Sales variance---sales volume variance

Absorption costing:sales volume profit variance=(budgeted units-actual units)*standard profit per units

Marginal costing:sales volume profit variance=(budgeted units-actual units)*standard contribution per units

③ Operating statement

03 联系

利润差公式:MC+OAR*(closing inventory-opening inventory)=AC

注:1.此公式的利润指两种成本核算方法下的净利润,不是contribution和gross profit的比较;

2.Closing inventory-Opening inventory=Production units-Sales units

3.此公式可以用于求OAR=(AC-MC)/(closing inventory-opening inventory)

以上便是吸收成本法(Absorption costing)和边际成本法(Marginal costing)之间的主要差异和联系了,你记住了吗~

推荐:考生都在用的ACCA资料>>【领取2023ACCA完整资料】 (资料包含ACCA必考点总结,提升备考效率,加分必备)

版权声明:

1、凡本网站注明“来源高顿ACCA”或“来源高顿、ACCA学习帮”,的所有作品,均为本网站合法拥有版权的作品,未经本网站授权,任何媒体、网站、个人不得转载、链接、转帖或以其他方式使用。

2、经本网站合法授权的,应在授权范围内使用,且使用时必须注明“来源高顿ACCA”或“来源高顿、ACCA学习帮”,并不得对作品中出现的“高顿”字样进行删减、替换等。违反上述声明者,本网站将依法追究其法律责任。

3、本网站的部分资料转载自互联网,均尽力标明作者和出处。本网站转载的目的在于传递更多信息,并不意味着赞同其观点或证实其描述,本网站不对其真实性负责。

4、如您认为本网站刊载作品涉及版权等问题,请与本网站联系(邮箱fawu@gaodun.com,电话:021-31587497),本网站核实确认后会尽快予以处理。

分享到:

急速通关计划

ACCA全球私播课

周末面授班

其他课程

报考指南

******ACCA备考机经

价值1288元 考试必备资料 免费领取 高顿ACCA研究院******出品

价值1288元 考试必备资料 免费领取 高顿ACCA研究院******出品

领取ACCA资料包

大家都在看

-

阅读(9579)

-

阅读(9083)

-

阅读(9068)

-

阅读(8764)

-

阅读(8739)

日排行 • 周排行

- 1 acca课程体系?acca考试具体内容有哪些?

- 2 ACCA FM | NPV和IRR两大评估方式+对比

- 3 acca考试具体内容有哪些?

- 4 acca考出来对进四大有帮助吗?

- 5 ACCA让我不再迷茫,打开全新视野!

- 6 超详细ACCA报考流程

- 7 ACCA F2重要考点解析

- 8 FA之Provision如何拿满分丨ACCA Cloud

- 9 ACCA知识点:增值激励计划

- 10 ACCA考试科目这盘“大餐“怎么搭配最“营养”

- 1 2023年ACCA考试科目通过率排名:哪些科目最容易通过?

- 2 2024年参加12月acca考试带什么?准考证可以打印了吗?

- 3 2024年accaf1裸考能过吗?历年通过率多少?

- 4 定了!2023年acca要考几年能考下来?要考几科才可以拿出去面试?

- 5 2024年acca要考几门?按什么顺序考?

- 6 2023年申请acca免考科目的条件?最多可以免考几门科目?

- 7 2023年哪些大学财会专业比较好?没错了,就是这几所!

- 8 acca学姐来解答2023年acca是什么考试?各科目全称是什么?

- 9 速看!2023年会计学acca是什么意思?一文教你看懂!

- 10 定了!2023年acca考位满了还有可能报上吗?

-

ACCA考试热门词

-

ACCA内部备考资料高顿ACCA为您免费提供全新ACCA资料,包括历年考题、考官报考、考官文章、考纲解析、学霸笔记、内部讲义等,同时还助您了解新学员报名注册指南、机考报考考试引导、OBU&UOL申请攻略等,点击免费获取。

-

- ACCA常见问题

- ACCA推荐阅读

- ACCA考试资讯

- ACCA原创文章

- ACCA学霸分享

- ACCA常见问答