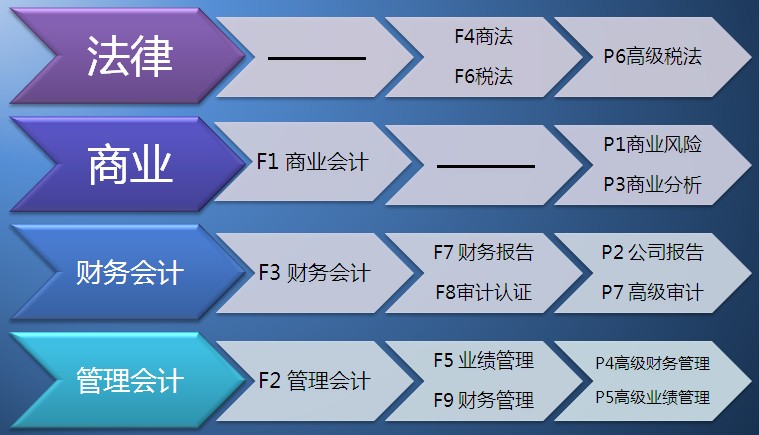

ACCA各科目内容介绍

(F1/FAB) Foundations of Accounting in Business

To introduce knowledge and understanding of the business and its environment and the influence this has on how organisations are structured and on the role of the accounting and other key business functions in contributing to the efficient, effective and ethical management and development of an organisation and its people and systems.

(F2/FMA) Foundations of Management Accounting

To develop knowledge and understanding of providing basic management information in an organisation to support management in planning and decision- making.

(F3/FFA) Foundations of Financial Accounting

To develop knowledge and understanding of the underlying principles and concepts relating to financial accounting and technical proficiency in the use of double-entry accounting techniques including the preparation of basic financial statements.

(F4) Corporate and Business Law

To develop knowledge and skills in the understanding of the general legal framework, and of specific legal areas relating to business, recognizing the need to seek further specialist leg advice where necessary.

(F5) Performance Management

To develop knowledge and skills in the application of management accounting techniques to quantitative and qualitative information for planning, decision-making, performance evaluation, and control

(F6) Taxation (UK)

To develop knowledge and skills relating to the tax system as applicable to individuals, single companies, and groups of companies.

(F7) Financial Reporting (INT)

To develop knowledge and skills in understanding and applying accounting standards and the theoretical framework in the preparation of financial statements of entities, including groups and how to analyse and interpret those financial statements.

(F8) Audit and Assurance (INT)

To develop knowledge and understanding of the process of carrying out the assurance engagement and its application in the context of the professional regulatory framework.

(F9) Financial Management

To develop the knowledge and skills expected of a finance manager, in relation to investment, financing, and dividend policy decisions.

(P1) Governance, Risk and Ethics

To apply relevant knowledge, skills and exercise professional judgment in carrying out the role of the accountant relating to governance, internal control, compliance and the management of risk within an organisation, in the context of an overall ethical framework.

(P2) Corporate Reporting (INT)

To apply knowledge, skills and exercise professional judgement in the application and evaluation of financial reporting principles and practices in a range of business contexts and situations.

(P3) Business Analysis

To apply relevant knowledge, skills, and exercise professional judgement in assessing strategic position, determining strategic choice, and implementing strategic action through beneficial business process and structural change; coordinating knowledge systems and information technology and by effectively managing processes projects, and people within financial and other resource constraints.

(P4) Advanced Financial Management

To apply relevant knowledge, skills and exercise professional judgement as expected of a senior financial executive or advisor, in taking or recommending decisions relating to the financial management of an organisation.

(P5) Advanced Performance Management

To apply relevant knowledge, skills and exercise professional judgement in selecting and applying strategic management accounting techniques in different business contexts and to contribute to the evaluation of the performance of an organisation and its strategic development.

(P7)Advanced Audit and Assurance (INT)

To analyse, evaluate and conclude on the assurance engagement and other audit and assurance issues in the context of best practice and current developments.